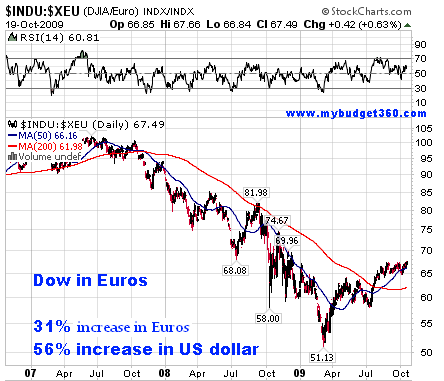

Many Americans have a hard time wrapping their mind around a declining currency or the hidden tax that is inflation. The U.S. Treasury and Federal Reserve understands this and for decades has exploited this issue to slowly siphon off the buying power of the U.S. dollar. Openly they tell the public that they are for a strong dollar policy but every action they take is guided to slowly debasing the currency. Take for example the current stock market rally. The Dow Jones Industrial Average is up 56 percent from the March lows. A stunning rally only seen one other time in history and we would need to go back to the 1930s for that. Yet at the same time, we have seen a collapse in the U.S. dollar. That is why oil, even though demand is relatively the same, is now back near $80 a barrel.

The Federal Reserve can easily strengthen the U.S. dollar. All they would need to do is increase interest rates to reign in liquidity. Yet this would crush the debt consumption in housing and autos. To show you the insidious way how the value of the currency is being washed away, take a look at the recent Dow rally in terms of Euros, a more stable currency:

LINK HERE

Did the Feds Make this Important Court Decision "Disappear"?

Court Orders Fed to Disclose Emergency Bank Loans

LINK HERE

This is a repeat of the previous great depression. The same game plan used back then is in motion today. Not far from now, the government will revalue the dollar. Many notable economists think this revaluation will be about 1/2 of what it is today. That would mean the dollar would go from 75 to about 38.

ReplyDeleteThis is about the same as in the great depression when the government revalued gold from $22/oz to $35/oz after confiscating gold from all it's citizens. Remember that we where still on the gold standard back then.

That little problem was fixed finally under Richard Milhouse Nixon, who floated our currency off gold thereby making it a fiat currency while the populace was diverted with the Vietnam issue.

I wish it would be worth 50%.

ReplyDeleteUnlikely.

More likely - Zimbabwe here we come. Where ten trillion will buy you an apple.

Total currency destruction, not a devaluation. If a 50% devaluation was the threat, BFD.