We have a confluence of five factors that have the potential to create damage to banking not seen in 80 years, and that includes the Great Depression. We'll hit these factors one at a time.

First Factor: Banks Are Not Doing Enough Business

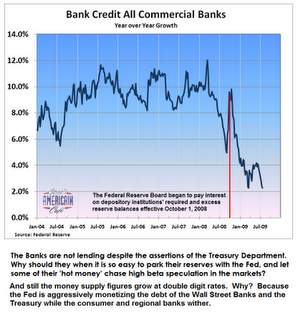

Commercial bank credit growth has dropped to 2%, according to Jesse's Cafe Americain (here). The recent history of credit growth is shown in the following graph.

Full article with graphs HERE

American Express sent me a notice today that they are raising their CC rates, their late fee rate, their membership rate, the misc service fees, etc.

ReplyDeleteThese are the bastards that filled out a two-page federal bailout form to be re-classified as a bank so they could hoard billions in our tax dollars.

When are Americans going to tell this scum including our mid-leaders and clown puppet president to shove it?

Do what I did with Amex and close out your account.If we start hurting these companies in the pocketbook, maybe they will get the picture and stop this wealth stealing of America. Unfortunately, many people are behind the 8 ball and can't pay off their credit cards and that's what Amex and all the others are betting on - so they continue to rape the small guys with their higher fees, rates, etc. As always, it's a one way street when the battle is between Main Street and Wall Street - Wall Street wins. This won't change until there is a total and complete financial collapse and who knows when that will occur.

ReplyDeleteYep; I agree. Closed out my account as well. The good news is the smaller guys are saying FU and not paying. And they are right. Why get screwed with high interest rates!? Flip the bird and get on with rebuilding your life and credit. After all, where in this wonderful investing climate is ANYONE getting 18%??? Why would you pay the full amount to the credit card company? Negotiate or just say NO!

ReplyDeleteIf it is safe to say that some need to credit card for some transactions who is the best of the scumbags?

ReplyDeleteI know Amex, Chase, Citi are up on the worst of the worst list, but is there any CC bank that are reasonable or are they all assholes?

Just for that rare transaction. I know Paypal is huge money vacuum also.

Yes, but twitmonkey Alan Greenspan was calling the US housing market "frothy" translated as lots of little bubbles.

ReplyDelete