FDIC is Insolvent: Look who owns 55% of Toxic Mortgages

The FDIC provides deposit insurance at 8,099 institutions. Collectively the FDIC overlooks $13.247 trillion in assets at these institutions. Instead of feeling protected you should feel weary because the FDIC deposit insurance fund is insolvent. Now the assets at these institutions range from softer side financial instruments like CDs and regular deposits but keep in mind that saving accounts are actually viewed as liabilities on the balance sheet of banks. This is money owed to you, the typical American saver. What is more nefarious is that these banks label high flying “assets” like commercial real estate loansand home equity lines as assets. In other words banks are optimistically pretending that many of their toxic assets are worth more than they claim they are really worth. And what is even more disturbing is the too big to fail banks make up the bulk of the FDIC total asset pool. Out of 8,099 institutions 4 banks in Bank of America, JP Morgan Chase, Wells Fargo, and Citibank make up 55 percent of that total asset pool:

(snippet)

The big four banks show up in the top six institutions. As you can see our banking system is largely concentrated in a few hands and the Federal Reserve is merely concerned in protecting these gigantic institutions even if it means using middle class Americans as cannon fodder in this economic battle. Even with mortgage rates, we keep hearing how wonderful rates are. Well of course because we are destroying our U.S. dollar to allow banks to borrow at near zero percent! And this is sold to the public as good? Why not let the average American borrow directly from the Federal Reserve and get the same terms at near zero percent? We are then told that banks need to verify the actual data. How well did that turn out in this massive housing bubble decade?

More Here...

(snippet)

The big four banks show up in the top six institutions. As you can see our banking system is largely concentrated in a few hands and the Federal Reserve is merely concerned in protecting these gigantic institutions even if it means using middle class Americans as cannon fodder in this economic battle. Even with mortgage rates, we keep hearing how wonderful rates are. Well of course because we are destroying our U.S. dollar to allow banks to borrow at near zero percent! And this is sold to the public as good? Why not let the average American borrow directly from the Federal Reserve and get the same terms at near zero percent? We are then told that banks need to verify the actual data. How well did that turn out in this massive housing bubble decade?

More Here...

The Scare Crow Bandits of Texas are going to prison for robbing banks in Dallas. One of them, Corey Duffey got 354 years. How many years can you get for stealing billions?

ReplyDeleteThe FDIC has one purpose. That is to give the sheeple the impression that their funds/savings are safe. To prevent bank runs until all your savings goes up in flames.

ReplyDeleteThat's why it's called the Federal DIC.

ReplyDeleteThe Federal DIC is powerful and large.

Fear the Federal DIC!

and bendover taxpayer

How is that hope and change working out for you. Obama is letting the taxpayer be put on the hook for all this financial mess while the bankers haul in billions in bonuses...

ReplyDelete3:21 Stop acting like a child; no one is saying Bush did not have anything to do with this. Stop posting your childish nonsense.

ReplyDeleteThe Bush, Palin, Obama, etc comments are nauseating. An American President's job is to stand in front of the cameras and give speeches written by our owners.

ReplyDeleteThey are nobody. Empty suits. Shills.

Banker owned. Corporate controlled minions.

Don't get mad at Obama when he spews that we need to give yet more power to the Federal Reserve. He is bought and owned by the owners of the Fed.

We haven't had a real President in 48 years. They are nothing.

We are a giant corporation with the same morals of a profit-seeking corporation. The board of directors (the Oligarchs that own this country) make the decisions behind closed doors, out of site. Decisions are NOT MADE by the front man/puppet.

Realize you live in an Oligarchy and it all makes perfect sense.

Voting is useless. Politics is useless. We are a clandestine empire and your vote or opinion MEAN NOTHING. You are a SLAVE. Get over it.

The number of applications for U.S. jobless benefits dropped last week as states whittled down a year-end backlog, bringing claims down to a level that signals companies are firing fewer workers as the economy recovers.

ReplyDeleteClaims fell by 43,000, more than anticipated, to 440,000 in the week ended Feb. 6, Labor Department figures showed today in Washington. The total number of people getting unemployment insurance and those receiving extended benefits decreased.

The fastest pace of growth in six years last quarter means the economy may be poised to add jobs as companies restock shelves to keep pace with increased sales. The Obama administration today projected payrolls will grow by 95,000 a month on average this year, indicating it will take a long time to recover the 8.4 million jobs lost since the recession began.

“Healing is under way, but this process will take time,” said Raymond Stone, managing director of Stone & McCarthy Research Associates in Skillman, New Jersey, who correctly forecast the drop in claims. “We are moving in the right direction and I think we will see some job growth” in coming months.

Stocks fluctuated between gains and losses as disappointment that European leaders didn’t provide specific solutions to solve the Greece’s debt crisis offset the drop in claims. The Standard & Poor’s 500 Index rose 0.4 percent to 1,071.82 at 11:36 a.m. in New York. Treasury securities fell.

Economists forecast claims would fall to 465,000, according to the median of 47 projections in a Bloomberg News survey. Estimates ranged from 440,000 to 485,000. The Labor Department revised the prior week’s claims figure up to 483,000 from an initial estimate of 480,000.

The drop in applications represents the end of an “administrative backlog” that built up when state government offices were closed during the year-end holidays, a Labor Department spokesman said in a press conference. The current figures signal a return to a more “normal” level of claims, he said.

Claims in California showed the biggest gains in early January, indicating that state was the one grappling to process applications, economists said.

“The reversal of the upward lurch in claims does allay concerns about a significant further deterioration in the labor market,” Michael Feroli, an economist at JPMorgan Chase & Co. in New York, wrote in a note to clients.

The blizzard that brought the eastern U.S. to a standstill, signals claims for this week will probably be affected by the weather, Feroli said.

The White House’s Council of Economic Advisers today predicted a monthly rise of 190,000 jobs on average next year and 251,000 in 2012, according to its an annual report to the president.

“There are strong signs that the American economy is starting to recover” and the labor market “appears to be healing,” the report said. “With millions of Americans still unemployed, much work remains to restore the American economy to health.”

Stone & McCarthy’s Stone said the administration’s 95,000 a month estimate for this year was “conservative,” and that the gain was more likely to exceed 100,000.

The number of American workers receiving benefits decreased to 4.54 million in the week ended Jan. 30, the fewest since January 2009, today’s report from the Labor Department showed. The continuing claims figure does not include the number of Americans receiving extended benefits under federal programs.

The number of people who’ve used up their traditional benefits and are now collecting extended payments dropped by about 171,000 to 5.68 million in the week ended Jan. 23.

The unemployment rate in the U.S. unexpectedly dropped to 9.7 percent in January, while payrolls declined by 20,000, Labor Department figures showed Feb. 6. Manufacturers added to payrolls for the first time in three years and that may provide some spark to revive the rest of the labor market.

4:15 the administration is posting their lies here now? How funny! That article reads like a fairy tale, nobody believes it anymore

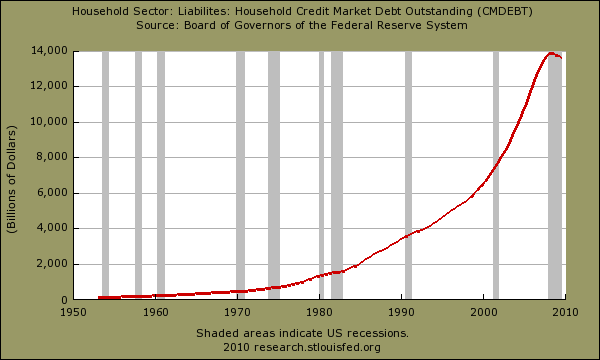

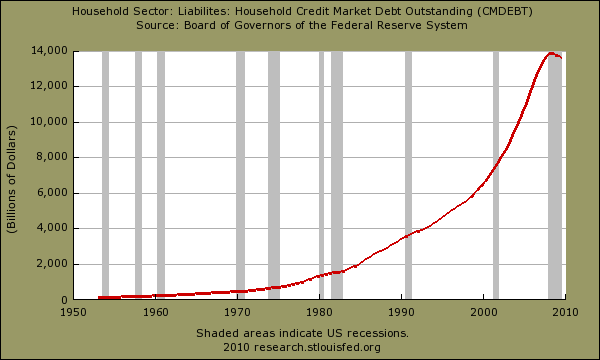

ReplyDeleteThis financial collapse has the earmarks of the many that preceded it in other developed nations. Excess debt, currency inflation, and over capacity in the manufacturing sectors around the world. The collapse will be systemic in nature. No, it is not different this time. It is a problem 25 years in it's making. Hold fast to your loved ones, assist and direct those wise enough to prepare. I wish all of you the best of luck my friends.

ReplyDelete4:15 I am one of those unemployed who will lose my benefits at the end of this month. I didn't even get one extension because Congress is going "on vacation" instead of fixing the problem.

ReplyDeleteSo remember, next time you heard "unemployment is down," that's because people like me and my husband will be living on the streets. The unemployment goes down whenever we lose our benefits. DUH!!!!!!!!!!

But that doesn't mean things are getting better. It means more people who will lose their homes and cars and less tax revenues.

Don't be so naive to believe everything the gov. tells you.

We are all so screwed! This house of cards will completely crash in 2011/2012. Perhaps there is truth in the Mayan Calendar and 12/21/2012.

ReplyDeleteIn one ceremony opening a new Temple, the Mayans cut the hearts out of 80,000 men over three days so that they could give their hearts to the Sun.

ReplyDeleteI too believe 2012 is close to game over, but I don't think it has much to do with the Mayans.

The thing to watch out for is not a "hyperinflation" but a devaluation. That will really incense Americans.

ReplyDeleteThe FDIC is one of the most deceptive organizations ever to hold the public "trust". It works solely for itself and not for the people.

ReplyDelete