U.S. Banks have a solid incentive, dipped in gold, to keep people in a perpetual state of paying rent on debt while not saving a shiny penny. In fact, their ideal state of financial equilibrium for Americans would be one in which people spent every single penny from their earnings reaching the end of the month like a pauper showing snake eyes in their savings account. This unfortunate banking structure has also been fostered by decades of government banking welfare for an entrenchedcorporatacracy. Now it is no responsibility of the government or banks on how people choose to manage (or mismanage) their money but when taxpayer money is used to subsidize the banking structure it is important to setup a system that is both fair and beneficial to the overall economy. That should be a minimum requirement. Today’s current system is designed to penalize savings and creates perverse incentives.

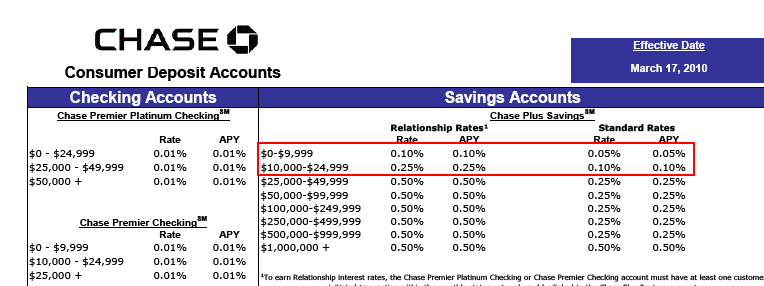

Let us first look at how absurd current savings rates are:

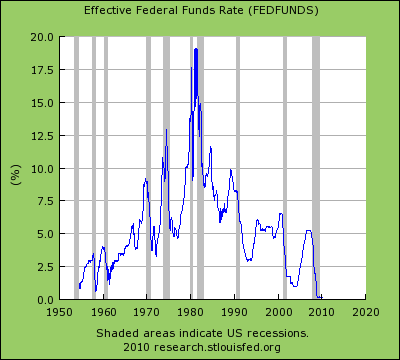

This rate is so low, that if you had $10,000 in a Chase standard savings account, after one year you would earn a whopping $10 or enough to buy two Big Macs or one movie ticket. What incentive is there to put your money in a bank account? They used to say people enjoyed watching their money grow but at this rate you’ll have better luck watching your lawn grow. Much of this low rate environment has been created by the Federal Reserve pushing the Fed funds rate to zero:

What incentive is there for saving any money for the typical family in the U.S.? And interest rates do make a big difference. Take for example the rule of 72. This is a quick rule where you divide a stated interest rate to see how long it will take to double your initial money. This actually highlights how important it is to get a solid rate:

72/15 = 4.8 years at 15% to double72/10 = 7.2 years at 10% to double72/5 = 14.4 years at 5% to double72/.1 = 720 years to double

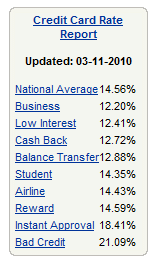

Right now, most of the too big to fail banks are offering that .1% annual interest rate. At the same time, they are charging astronomical rates on credit cards and other loans making up a margin that would embarrass even your local loan shark:

More Here..

Quit complaining, if you had that money in Australian banks, after a year you would actually have lost money!

ReplyDeleteThere is no reason whatsoever to have your money in a bank except for what so need for transactions. Get your saving the hell out of these criminal banks.

ReplyDeleteEspecially anything that has the arch criminal's name on it - JP Morgan/Chase.

the notion that banks needed your money to have as an asset to give them leverage to make more money (whilst paying you a portion in the form of interest) is long gone...banks dont need your money anymore... the have a private ATM from the Fed and Treasury.. now they can just take your money use it to make their balance sheet look rosy and use all the Fiat money to make bets with. All the while screwing you with fees for processing, transactions, overdrafts, paying almost zero interest and charging 15% on your credit card balance....

ReplyDeleteWell boys and girls I guess you know what that means right?

ReplyDeleteMore of those “competitive” 1% or less CD’s……………….!

This is all orchestrated to keep the CPI down so they can justify no COLA, keep bank rates low so savers will spend it or run off with the Boo ya boys to the maaaaaket, while all kinds of new tax and fees, and price increases eat up what’s left.

Just found out they are raising the water bills here by 100%, but of course that doesn’t count in the CPI either.

Hang in there savers, hold on to it as long as you can, they’ll have to raise sooner or later,

I seen this before, didn’t pay much attention to it all than, didn’t have much saved than, smirks.

Being in a credit crisis is not the governments' fault, it is the individuals. I have never bought anything on a credit card that I could not immediately pay off. I have taken all my cash out of banks, except for bare bones checking purposes. If we all united in this way, the banks would be brought down. I hope all of you wake up soon.

ReplyDeleteGiving <1% and charging >13%. Fuck. I wish I could join in with these thieves and fleece the sheeple.

ReplyDeleteRe,

ReplyDeleteThe 72 rule above that’s for normal people.

Ah ,

but if you are a fractional reserve bankster and can issue debts at say eight times your fictional reserves and collect interest x8 .

Then we have to multiply the results of the 72 rule by 8

It does not take long at all to double your capital.

Usury multiplied

For crest sake, WTF is it with you super "financial" wizards, its that damned BOOYA clown on CNBC and the rest of the talkin heads that push stocks all damned day. It’s the screwball day traders that buy and sell every second to some other jerk back and forth.

ReplyDeleteIt’s that Larry dude that pimps Goldie and than plants seeds, its the bald headed pig tailed half wit with his puts and shorts crap. Its that damned Ben keeping rates at 0% for the banks while they buy treasury’s at 3%, charging 30% on loans if you can even get one and giving back 1 or less % on savings. Its the GOV buying up sub primes to keep freddie and fanny from going under.

Its The Gov BSing on the CPI figures, to keep from paying COLA and telling people how there's NO Inflation , maybe you 6 or 7 figure a year type think there's no inflation, but than why would you, unless that yacht goes from 2 mil to 3 mil.