To put it bluntly, the U.S. housing market today is in deep water. Nothing exemplifies the transfer of risk to the public from the private investment banks more than the deep losses at Fannie Mae and Freddie Mac. Fannie Mae announced a stunning first quarter loss of $13.1 billion while Freddie Mac lost $8 billion. At the same time, toxic mortgage superstar JP Morgan Chase announced a $3.3 billion profit for Q1. This reversal of fortunes has been orchestrated perfectly by Wall Street. Since the toxic assets were never marked to market, the big losses have been funneled to the big GSEs (and as we will show in this article, now makes up 96.5 percent of the entire mortgage market). In other words, banks are making profits gambling on Wall Street while pushing out mortgages that are completely backed by the government. We are letting the folks that clearly had no system of underwriting mortgages correctly or any financial prudence lend out government backed money and the losses are piling up but only in the nationalized Fannie Mae and Freddie Mac. What a sweet deal. Stick the junk in a taxpayer silo.

I wanted to go into the details on the current U.S. housing market and the data is not pleasant. In fact, it is downright disturbing. For background information, the U.S. has roughly 51 million active mortgages. As we go through the next 10 charts, it is important to keep this in mind. Whitney Tilson’s T2 Partners came out with some riveting charts regarding the current state of the housing market. Let us go through 10 of the most crucial charts.

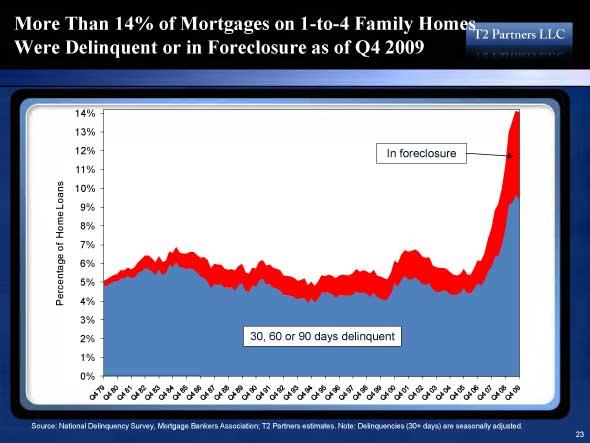

Chart 1 – Homes in foreclosure

The ultimate sign of housing distress is foreclosure. This should be obvious. So for all the talk of a housing recovery I point to the above chart. Today, as in right now, we are in record territory for the number of homes in foreclosure. 14 percent of all U.S. mortgages are in some form of foreclosure. If you do the rough math, this equates to:

51 million x .14 = 7,140,000 mortgages in default or 30+ days late

I always get this question about how folks arrive at the figure of 7 million. The above equation should give you an idea. This by the way is not a good situation. And with many toxic loans including option ARMs and Alt-As still lingering in the market, we have a few more years of problems baked in unfortunately.

Do the FEMA camps have the capacity to handle tens of millions of displaced people?

ReplyDeletei think they

ReplyDeletehave gas chambers there

rooms wont be filled for long

820

Worry not earthlings. The solution to all your problems, is to make more and more kids. There is no upper limit. Only when there is a population of 28 billion billion billion billion will all of our problems be solved.

ReplyDeleteProceed with the manufacturing of more advanced pets.

I am going to try and sell my second home for whatever I can get. It won't be pretty, but it will be a lot worst a year from now.

ReplyDeleteHave got the 'wake until the market recovers' speech' from everyone. Not gonna happen for at least a decade, probably never.

i think they

ReplyDeletehave gas chambers there

So long as they have texting, blogging, twittering, gaming and facebooking there, you can gas the people all you want. Frankly, you could do anything to them so long as you provide the above.

This comment has been removed by a blog administrator.

ReplyDeleteThis is very depressing information, especially in that the very few know about the Next Wave Of Housing Collapses, as the sheeple think everything is aok.

ReplyDeleteOh well, better get back to watching faux.

OMG.. iam shocked,,, i thought everything has great now.. Just ask Arnold in Taxifornia

ReplyDeleteThe sheeple of this country as so far gone..

SPend Spend SPend and when you are done Spend some more

Arnold really isn't singing that tune anymore. He is no longer upbeat.

ReplyDeleteReal estate will be sideways at best for the next ten years. Will not keep up with inflation. Can't wait to see what happens when interest rates are set properly.

ReplyDeleteThey told me that Real Estate never goes down. I sold my house in 96 bought silver. Tired of renting from deadbeat landlords who don't pay their mortgage. let the housing market crash! I can;t wait to buy my next home for 100 ounces of silver.

ReplyDelete